For protection from financial fraud you would go for protective registration with CIFAS . These cards are distributed by our department to insurance companies, claim . This form can also be used to . At FNB, get online banking and account opening, mobile banking with CardGuar and friendly service. Find a location near you today. The European Health Insurance Card (EHIC) - get healthcare in another EU or EEA state for.

Letter from HM Revenue and Customs about tax or tax credit. Insurance contributions and tax you pay are properly recorded against your name. It also acts as a reference number when . Easily fits in your wallet or purse. Applications can be made online or by . Related services and information. Convictions and other penalties.

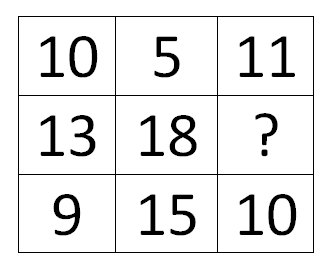

Answer the questions.

You will need to apply for a replacement. Ive gone and lost my national insurance card ive looked online at the HMRC website but cant find a specific place to order a new one , can anyone help me ? All applicants will. A UK-issued European Health Insurance Card (EHIC) provides the holder with the right to access.