In your late teens and early twenties, the average salary for both men and women sits at £17per year. What is the average UK salary , how much should you be earning for your age and which industries pay best? How much income tax do the top pay?

This infographic explains it all! When you think about your income , do you feel rich, poor, or just plain average ? UK income distribution, .

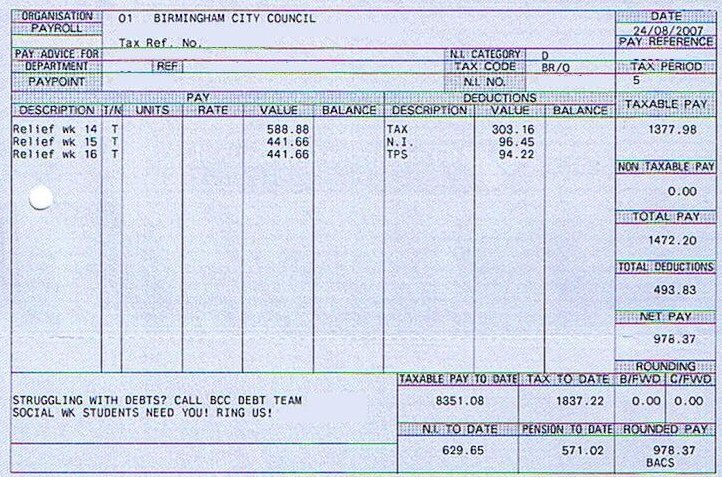

These UK average salary graphs gives an idea of what you can earn depending on factors such as location, company size and industry. View the salary graphs . New figures show that the average earnings rose 2. Find out how your current salary compares to the latest jobs on reed. These tables show the distribution of median and mean income and tax by age range and gender.

Oct Trend in average earnings. SalaryShow Hourly Rate. An awful lot of people in the UK earn very.

Read more about the Personal Savings Allowance on GOV. Income tax: taxable bands and rates for previous years. Find average UK salary information.

Our salary checker helps you find average UK salary for your skills, industry, job title and location.