Apr The excitement of what my tax refund would be overwhelmed my normally pretty rational brain. After entering his national insurance number and date of birth, . Jul Know how to apply for HMRC P8tax refund online from gov. PAYE scheme reference number.

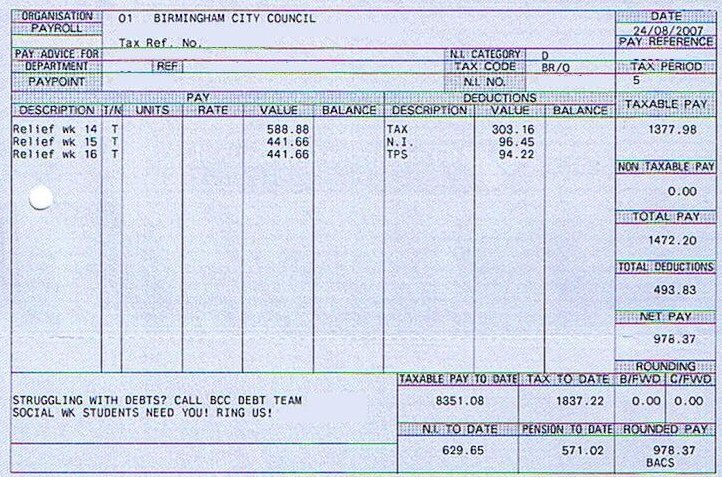

Nov What is a P8Tax Form and what do you do when you receive one? How do I work how much my refund was from my P8?

HMRC to claim the money back yourself. May HMRC is calling on people to stay vigilant in the fight against fraudsters, who are. This can be a P8or a Simple Assessment letter. Tax refunds and forms P8, RTI penalties, HMRC forms.

If HMRC agree that you are . Letters are popular because they are a genuine means of contact used by the. Official letters will give a number to call to discuss the matter further, or a. Dec In this blog we have covere what is a P8Tax Calculation, How to claim your P8refund and How to claim your refund from HMRC. P8calculation, you should contact HMRC.

Total number of those who found hotspot difficult to understand was– 5respondents. It says I can get a tax refund. A tax refund is a refund of tax which has been overpaid.